Are you regularly shopping on Flipkart and have chosen How to Close Flipkart Pay Later option for payment? If you’re interested in finding out how to deactivate this service, you’re in the right place. This service is favored by many who prefer to consolidate their Flipkart purchases into a monthly payment, avoiding the need to process payments with each purchase. Note that the Flipkart Pay Later service is only accessible to certain qualified customers. If you haven’t used this service yet, you can determine your eligibility by checking your Flipkart profile. This service is provided in collaboration with IDFC First Bank Ltd. and can also be verified in your CIBIL profile under active accounts. In this informative blog, we will guide you step-by-step on how to deactivate your Flipkart Pay Later account.

How to Close Flipkart Pay Later Service?

People often close their pay later accounts for various reasons such as concerns about their CIBIL score, preference for alternative payment methods, or difficulties in managing monthly payments due to high shopping volumes. If you’re having trouble locating the option to deactivate Flipkart Pay Later, here are the steps you can follow to permanently close your account:

1.Access Your Flipkart Account

To begin, sign in to your Flipkart account. Use the email address or phone number and password that you chose when setting up your account for logging in.

2. Go to the Flipkart Help Center

Once you’ve successfully logged in, it’s time to navigate to the Flipkart Help Center. Search for a personalized icon, typically located in the top right corner of the page.

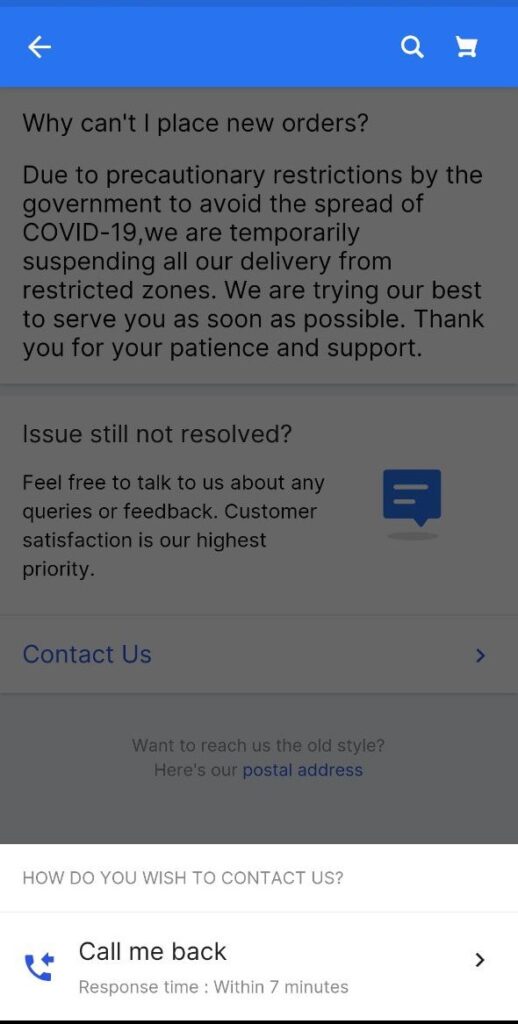

3. Locate the ‘Chat’ or ‘Callback option’

The crucial step in disabling the ‘Pay Later’ feature on Flipkart involves navigating the help center page. Here, you should select the option labeled “I want help with other issues.” After this, proceed to the “others” section located at the end of the list. Once you click on “others” in the subsequent drop-down menu, you will be presented with the option to request a callback.

4. Request a Call Back

Upon requesting a callback, a customer service representative from Flipkart will contact you within 5 to 10 minutes. Kindly request assistance from the support team in permanently closing your Flipkart Pay Later IDFC bank account. It’s important to emphasize that you wish to permanently close the account, rather than just deactivating or temporarily suspending it.

5. Account Closure and Timeline

Following your conversation or call, the process of closing your Flipkart Pay Later account will commence and is expected to be completed over the next month. It’s important to remain patient during this period. Typically, within 2 to 3 months, this closure will be recorded in your CIBIL report as “closed.”

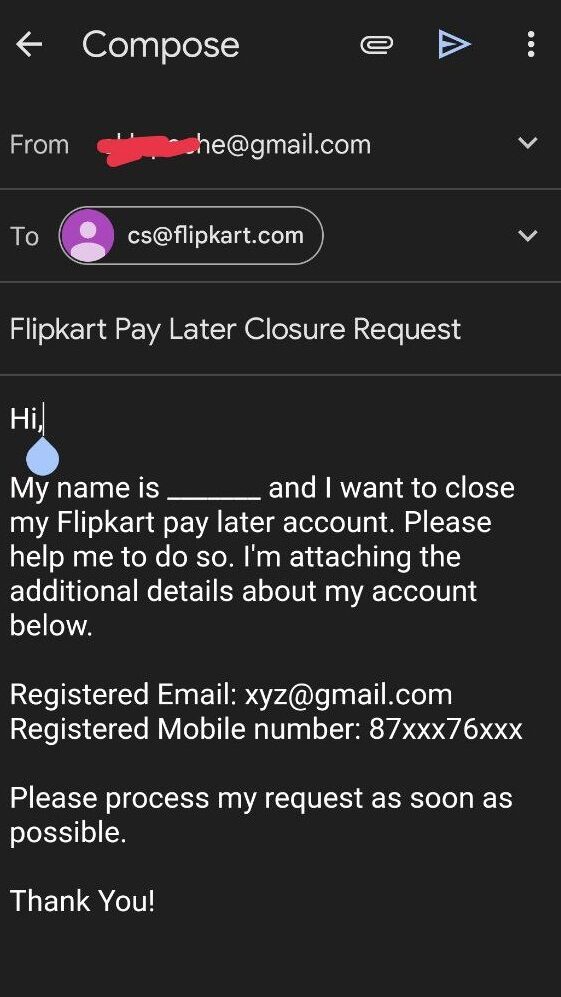

Send Email for Closure Request

If you’re struggling to understand How to Close Flipkart Pay Later, another option is to email Flipkart directly. Use the email address you registered with and send your request to “Cs@flipkart.com”. It’s important to be clear in your email subject line about your intention, for instance, you could write “Request to Close Flipkart Pay Later Account”.

Below is a suggested format for your email.

“Once you’ve emailed them, a representative might respond via email or contact you on the phone number you’ve provided. It’s important to note that emailing is a secondary option and does not assure a response or account closure. For instructions on deactivating Flipkart’s pay-later service, it’s advisable to primarily reach out to the help center.”

Try Contacting RBI Ombudsman

The Ombudsman of the Reserve Bank of India is responsible for handling grievances and issues pertaining to financial services, which encompasses issues with your Flipkart Pay Later account. It’s advisable to present your case to them, detailing the issue and outlining the actions you’ve already undertaken.

It’s important to gather and prepare all necessary information prior to submitting your complaint to the ombudsman for resolution.

Things to Remember Before Closing Your Flipkart Pay Later Account

- Before you proceed with closing your Flipkart Pay Later account, make sure to settle any remaining balances.

- This is crucial for a hassle-free account termination process. Upon initiating the closure of your account, expect to receive a No Objection Certificate (NOC) from IDFC First Bank, the lending partner for Flipkart Pay Later, within a period of 2-3 weeks.

- In case you do not receive this certificate within the specified time frame, feel free to reach out to the Flipkart help center for assistance.

It is important to remember that the decision to How to Close Flipkart Pay Later account is final and cannot be reversed. Once the account is closed, you will no longer have the option to reapply for this service. The act of closing your Flipkart Pay Later account may seem minor, but it requires careful consideration. This guide aims to assist you in successfully terminating your Flipkart Pay Later account.